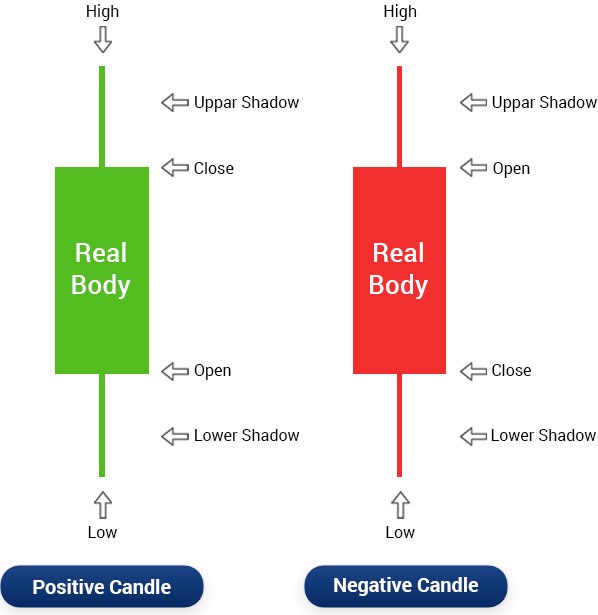

In relation to practical analysis, candlestick maps are one of the most widely used resources that dealers use. These maps provide a very clear and concise method to imagine cost activity, and they also may be used to location possible buying and selling opportunities.

Nonetheless, before you begin while using types of candlesticks, there are several issues you should know. In this post, we’ll lightly go over what candlestick charts are and then plunge into three significant specialized signs you should watch out for when you use these charts.

Specialized Indications to observe for When Utilizing Candlestick Maps:

Now, let’s discuss three crucial technological indicators that you should watch out for when utilizing these maps.

1. The 1st indication is called “assist and level of resistance.” As its title indicates, support and resistance degrees show where costs will probably find assist or amount of resistance. These amounts can be recognized by searching for styles for example twice bottoms or tops, mind and shoulder blades styles, and so forth.

Once these amounts are identified, forex traders can then watch for value activity to verify these ranges as assist or opposition. If price ranges relocate in favor of the trader’s place after reaching these degrees, it is a very good indicator how the levels applies.

2. Another indicator is named “craze collections.” Pattern lines are simply right collections which can be attracted through cost highs or lows to be able to establish the path of your total tendency. Dealers can make use of tendency collections to get in or exit trades, as well as to place cease-reduction orders.

3. The next and ultimate signal we’ll discuss is referred to as “energy.” Energy steps how quickly prices are transferring a certain path. This is very important because it can provide traders a young caution signal which a trend is about to transform instructions. Momentum could be calculated utilizing oscillators such as the General Energy List (RSI) or MACD.

Parting note:

These are just three of many specialized signals that traders may use when forex trading with candlestick maps. In order to be successful, it’s vital that you experiment with diverse indications and see which ones job good for you. With more experience and persistence, you’ll be capable of place possible investing prospects effortlessly!